- VA loan closing costs typically range from 3% to 5% of the loan amount.

- The VA limits what closing costs buyers can pay, helping reduce out-of-pocket expenses.

- Sellers can cover all loan-related costs and up to 4% in concessions.

Every mortgage comes with closing costs (even those advertised as "no closing cost" loans). A home loan is a product, and like any kind of good or service, there are related costs.

So, what exactly is included in “closing costs” for a VA loan? As it turns out, “closing costs” is really a catchall term for any cost or fee required to finalize your mortgage. Some closing costs represent underwriting and processing fees, while others involve third-party expenses like homeowners insurance and property taxes.

Here's everything you need to know about VA loan closing costs.

How Much Are Closing Costs on a VA Loan?

The amount of closing costs you’ll pay on a VA loan will vary by person, but expect to pay anywhere from 3% to 5% of your total loan cost.

Who Pays Closing Costs on a VA Loan?

It is the homebuyer's responsibility to pay for VA loan closing costs, but sellers can negotiate to cover a portion of these expenses.

The VA limits what borrowers can pay in closing costs, and there are actually some costs Veterans aren't allowed to pay. What often confuses VA borrowers is the difference between closing costs and concessions on a VA loan.

This is often misconstrued, misrepresented or outright mistaken, so let's state it as plainly as possible: There is no cap on how much a seller can contribute on VA loan closing costs. But there is a cap on what's known as concessions.

Seller Concessions on VA Loans

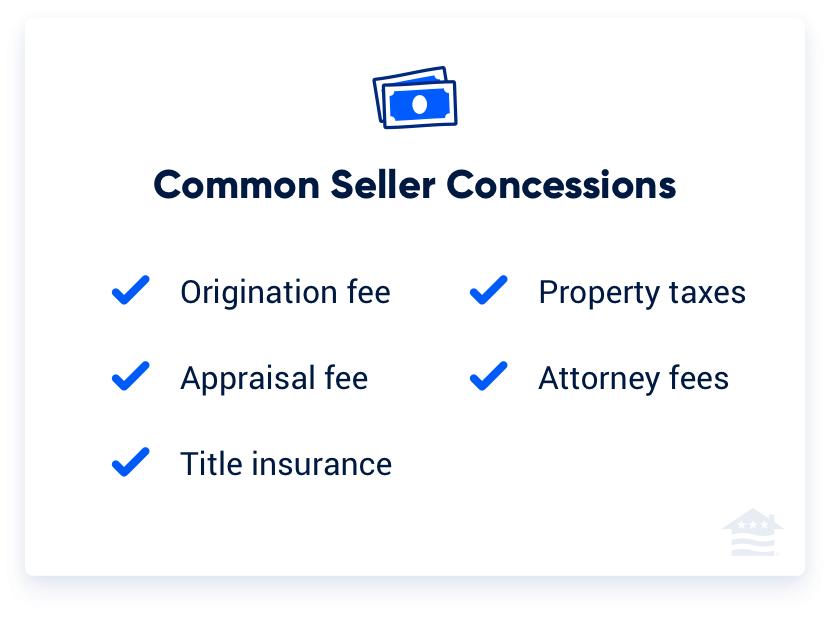

A seller concession on a mortgage is any cost the seller pays that is not required of them.

With a VA loan, seller concessions are limited to 4% of the total loan price.

Some of the most common VA loan seller concessions include:

As long as you stick to that 4% cap, the sky’s the limit when it comes to asking for concessions. But remember that seller concessions are not required, so this will always be a product of negotiation between buyer and seller.

Before you begin negotiations, you’ll need to know exactly what you want to ask for.

How Do VA Loan Closing Costs Differ From Other Mortgages?

In general, the only closing cost specific to a VA loan is the VA Funding Fee. However, the VA sets additional guidelines for some closing costs on VA loans, such as a limit on the origination fee that lenders can charge and a limit on the type of closing costs that Veterans can pay.

List of VA Mortgage Closing Costs

Let’s take a look at how the Department of Veterans Affairs (VA) regulates closing costs for a VA loan:

The Origination Fee

The VA loan origination fee rule limits the amount a lender can charge for originating a VA loan to 1% of the loan amount.

VA lenders can either charge you a flat 1% fee or itemize your loan origination fees, so long as they don’t exceed 1%. If the lender isn't charging the flat 1% fee, then the VA allows buyers to pay for some fees that would otherwise be non-allowable.

Non-Allowable Fees

Non-allowable fees on a VA loan are expenses that the VA prohibits the buyer from paying when the lender charges the flat 1% origination fee. The goal is to ensure Veterans and service members using their VA loan benefit can purchase homes without paying additional items that the VA considers overhead.

See our complete list of non-allowable fees for 2025.

Appraisal Fee

VA home loan buyers are required to get a VA appraisal. The VA sets costs for appraisals, not the lender. VA appraisal fees vary from $400 to $1200, depending on where you’re buying, and must be paid upfront.

Well, Septic and Termite Inspection Fees

The VA requires borrowers to get termite inspections depending on where they live in the country. If the appraised property has a private well and septic system, the VA requires a water and well test.

VA buyers are allowed to pay the termite inspection fee when a termite inspection is required. The VA also allows buyers to pay for any repairs stemming from well or septic issues.

VA Funding Fee

VA buyers are also subject to the VA Funding Fee, a mandatory charge that goes straight to the VA to help keep the program running. Your funding fee amount will vary depending on the loan type, whether or not you are making a down payment and whether it's your first or subsequent time using the loan.

For most first-time VA buyers, this fee is 2.15% of the loan amount, provided you’re not making a down payment. Buyers who receive VA disability compensation are exempt from paying this fee.

Another option is the seller may agree to pay your VA Funding Fee as a seller concession rather than have you add it to your loan amount.

Other Common Closing Costs

Now, here’s a look at some of the common closing costs that work similarly across all mortgage types:

Discount Points

Buyers can pay “discount points” to lower their interest rate. A point is equal to 1% of the loan amount. You’ll also hear this called a “permanent buydown” because you’re paying money upfront to buy a lower interest rate.

Typically, one discount point costs 1% of the total loan amount and lowers your interest rate by 0.25%.

Title Insurance Fees

Title insurance protects lenders and homebuyers if liens, legal defects or other title-related issues are discovered after closing. Lenders will usually require the purchase of the lender’s title insurance, which protects their interest in the property. You should strongly consider paying the one-time fee for the owner’s title insurance to ensure you’re also covered.

Credit Report

In 2024, FICO increased its royalty fees by over 40%. Together with price hikes from Equifax, Experian and TransUnion, lenders now typically charge between $50 and $110 for credit reports. These costs vary depending on whether the report is for a single borrower or a joint application.

Property Taxes and Homeowners Insurance

You might hear these referred to in the context of an “escrow account.” Your local municipality will levy property taxes on an annual basis. You’ll also be responsible for paying for homeowners insurance. At least a portion of these annual bills will be due at closing.

Daily Interest Charges

Your mortgage is paid in arrears, meaning your mortgage payment covers the costs that were incurred in the past month, as opposed to being paid in advance for the upcoming month. So, if you close in mid-September, your first mortgage payment most likely won’t be until November 1.

Lenders will collect the prepaid interest that accrues between your closing date and the end of the month you close. Lenders calculate daily interest as a per-day rate, and that prepayment is due at the closing table.

Recording Fees

State and local governments charge fees to record your deed and mortgage-related documents. Some of your real estate transaction details will become public records, accessible to anyone in your community and beyond.

Homeowners Association (HOA) Fees

There may be costs and fees associated with closing a loan on a property in a homeowners association. It's common for homeowners associations to charge annual dues, which may need to be factored into your closing cost picture.

Home Warranty Fees

You may decide to obtain a home warranty on a property. These policies will often cover the cost of certain repairs during the first year you own the home. Sellers typically pay this expense.

Real Estate Commissions

The listing agent and the buyer’s agent will often split a predetermined commission based on a percentage of the home’s sale price. This commission typically comes from the seller's sale proceeds.

Can You Roll Closing Costs Into a VA Loan?

The VA Funding Fee is the only closing cost that can be rolled into a VA loan. VA buyers can ask the seller to pay it, but doing so would count against the 4% concessions cap.

Another potential approach is to ask the seller to lower the home price by whatever the fee totals.

When Will I Know My Final Closing Costs?

You won’t get an official estimate of your closing costs until a lender has a full application that includes information on your income, your credit and a specific property address.

Once a lender has that application in hand, they’re legally required to send you some key documents and disclosures within three business days. One of the most important is the Loan Estimate.

The Loan Estimate

Your final closing costs will be stated in your Closing Disclosure, but the loan estimate offers an early and detailed picture of your mortgage’s estimated costs.

The Loan Estimate will include:

- A closer look at the loan amount, the interest rate and the monthly principal and interest payments of the loan

- Your projected monthly payments over the life of the loan

- A detailed breakdown of your estimated loan-related closing costs, such as origination charges, appraisal fees, title insurance and more

- A detailed breakdown of other estimated costs to close, such as prepaid taxes, homeowners insurance and interest charges

- A total estimate of how much cash you’ll need to close, including the down payment amount

- Information about your borrowing costs, annual percentage rate (APR) and total interest percentage (TIP) that you can use to compare with other loan offers

- Information about appraisals, assumptions, late fees, loan servicing and more

The Loan Estimate is ultimately an estimate, and that means some of the projected costs can change. But there are limits on what charges can and cannot increase and by how much.

This is why it’s so important for VA buyers to get preapproved and to talk with their lender before making an offer on a home. The sooner you and your real estate agent communicate with your lender about a specific property, the faster they can prepare a Loan Estimate. And that helps ensure you ask for the right amount of closing costs and concessions in your offer.

Veterans United Closing Cost FAQs

Below are common questions about Veterans United's closing costs to help you feel more confident and prepared:

Does Veterans United Allow Borrowers to Purchase Discount Points?

Veterans United allows borrowers to purchase permanent and temporary discount points at closing. “Temporary buydowns,” which allow you to lower your interest rate for a predetermined period, typically several years.

Does Veterans United Itemize Origination Fees?

Veterans United typically charges the flat 1% origination fee and does not itemize various origination costs and fees.

Does Veterans United Offer Closing Costs Assistance?

VA homebuyers may be eligible for a closing cost assistance loan through a relationship that Veterans United has secured with an independent bank. These short-term loans can cover closing costs, prepaid items and discount points. The maximum loan amount is $20,000, and you must have a purchase contract to submit a closing cost assistance request.

Additionally, VA assumptions are ineligible for any closing cost assistance. A Veterans United loan specialist can provide more details about this closing cost assistance loan option.

Does Veterans United Cover Closing Costs?

Veteran buyers can always negotiate the payment of closing costs with sellers. Sellers can pay all loan-related costs and up to 4% in concessions, which can cover prepaid items and more. In some cases, buyers may be able to utilize a lender credit to cover some or all of their closing costs.

Talk with a Veterans United VA loan expert at 855-870-8845 or get started online today to learn more.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Apr 23, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Updated article to include new information about Veterans United closing costs.

Dec 12, 2024

Written ByChris Birk

Reviewed ByDon Wilson

Fact checked and reviewed by underwriter Don Wilson.

Related Posts

-

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom.

What is Credit and Why It’s ImportantDiscover why credit matters when buying a house. Learn how a strong score unlocks lower rates, better loans, and more financial freedom. -

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.

Home Inspection for VA Loans: Guidelines and ChecklistLearn about the purpose of a home inspection, common issues and how a home inspection differs from the VA appraisal.